AIR-Q Insurtech Forum 2.0: Is this the future of Insurance?

There is good reason to believe that insurance is heading down the path of major disruptive innovation, but few are putting InsurTech at the heart of their strategy

Earlier this month, I had the privilege of hosting an Insurtech forum with four Insurtech industry leaders for the Actuarial, Insurance, Risk and Quants (AIR-Q) society at the Business School (formerly Cass).

As an MSc Actuarial Science student and co-president of AIR-Q society, I hope to share my passion for applying and enriching knowledge of the insurance industry. Further, as someone who comes from a mathematical background, I understand the fear of approaching new technical jargon, when hearing from professionals or reading articles. Therefore, I hope to bring clarity to help break down the barrier between high performing professionals and students through my role as co-president.

As an MSc Actuarial Science student and co-president of AIR-Q society, I hope to share my passion for applying and enriching knowledge of the insurance industry. Further, as someone who comes from a mathematical background, I understand the fear of approaching new technical jargon, when hearing from professionals or reading articles. Therefore, I hope to bring clarity to help break down the barrier between high performing professionals and students through my role as co-president.

In our recent forum, we looked through the lens of InsurTech leaders to understand current trends and business models that are employed. We also discovered the intricacies that are worth paying attention to, as part of this monumental shift in the industry.

The panel consisted of the following Insurtech leaders:

- Michael Robinson: VP, Insurance Transformation and Digital at Genpact

- Sabine VanderLinden: Co-founder and CEO of Alchemy Crew

- James Birch: Head of Innovation at Brit Insurance and Development Director of Ki Insurance

- Sebastian de Zulueta: Founder and CEO of Market Minds

Transforming Insurance Carriers from Companies using Data to Data Companies in Insurance

The event began with a presentation by Michael. He shared five trends he believes are helping companies thrive in the current digital world:

- The shift from offline to online

- The virtualisation of all technology, services, and solution delivery

- Accelerated consumption of cloud-based services and solutions

- Increased demand for real-time predictive analytics to drive decision making

- All built and delivered around human-centred design

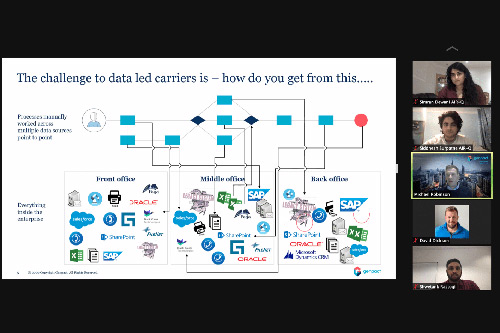

Michael shared data which demonstrates the major drivers and challenges encountered by carriers. In the legacy systems, there are processes manually worked across multiple data sources point to point. The real challenge is how to go from the legacy system to processes worked across multiple data sources with orchestration layer end to end.

Further, Michael shared with us a quote from a colleague “An AI is like a 14-year-old girl”, in his explanation of some of the pitfalls of AI and how Intelligent Automation is shaping the future of work, a more human-centred digital delivery of work.

InsurTech in 2020: Lens on InsurTech investment and partnerships

Sabine focused on Insurtech sector investment funding and trends. She stated that Insurtech investments in 2020 have gone towards mature ventures with established business models. Some investors have favoured companies that are pure digital players, with a focus on niche market segments. Others have primarily gone on to target small business and gig economy worker propositions. It is no surprise that cyber risk prevention & the reduction of cybercrime are top of mind. Lately, cognitive intelligence solutions are securing funding where they can support a range of operational transformation activities.

Some of the investment strategies used by insurers have included making investments in emerging technologies (IoT, Big Data, Cloud, 5G, Blockchain, Mobile, and AI). Insurers have already allocated significant funds to these technologies and are combining them into unique capabilities.

She concluded by suggesting that Insurtech players need to join the dots by including ‘differentiating platform’ and ‘ecosystem thinking’, into the mix.

Insurtech – everything you need to know to participate in the disruption of a multi-trillion-dollar industry

Sebastian spoke about the similarities between Insurtech and the Fintech market. He discussed where the money is, what it takes to build an Insurtech firm and the power of dynamic between incumbents and new entrants in Insurtech disruption. Given Sebastian’s expertise in African Insurance market, he also spoke about the emerging markets and the evolving nature of insurance services being offered. He shared a myriad of knowledge including where the demand is and why the youngest populations, such as Africa, are a good market. With the rise of online banking, embedded finance is more prevalent in Kenya than it is in Texas.

Below are the links to register if you would like to attend the insurance conventions mentioned by Sebastian to hear further about emerging markets in Insurtech:

Ki Insurance: the first fully digital and algorithmically driven Lloyd’s syndicate

James talked about Ki being the first fully digital Lloyd’s of London ‘follow only’ syndicate. Ki has teamed up with Google cloud and enlisted the help of the computer science department at University College London (UCL) to design the algorithms.

Ki is a Brit Insurance venture which aims to redefine commercial insurance by bringing disruptive technology. This will certainly challenge the traditional industry designed by brokers by providing a more efficient way of getting quotes in the Lloyd’s of London. The vision is to make Lloyd’s more comparable to the London Stock Exchange, by digitalising risk. The benefits here are twofold: brokers get a more user-friendly and timely way to access follow positions, and Brit can carve out a huge chunk of cost from the lengthy end-to-end process by using technology.

Opening the discussion with the floor

Speaker’s presentations were followed by an open discussion between speakers and guests, moderated by Siddhesh Surpatne. We were pleased to have a very engaged audience, who put forward thought-provoking questions making the event very interactive.

The AIR-Q society was honoured to have Michael, Sabine, Sebastian and James share their knowledge with everyone, and we would like to extend our sincere gratitude to them.

Thank You

The founder and presidents of AIR-Q society (Peter V, Ruby Ison, Harry Parker, Vered Opoku-Baffour, Simran Dewani and Siddhesh Surpatne) would like to thank the Business School (formerly Cass) careers and events team, specifically Leon Cuthbertson for his help in setting up a successful webinar. Many thanks to our attendees, and especially the speakers for their wonderful and insightful presentations on the reshaping the insurance industry. Together, you made this event a success. We hope to host more enjoyable and informative events in the future.

Follow AIR-Q society to join us for future events: