Data Science and Artificial Intelligence in actuarial work

Hello, I'm Siddhesh Surpatne. I am currently studying the MSc in Actuarial Management and I am also Co-President of the Actuarial, Insurance, Risk and Quants (AIR-Q) Society.

Earlier this month, I had the privilege of hosting a talk on “Data Science and Artificial Intelligence in Actuarial Work” with Hash Piperdy for the Actuarial, Insurance, Risk and Quants (AIR-Q) society at the Business School (formerly Cass).

The AIR-Q society

The AIR-Q society is one of the most vibrant society at the Business School with a strong network (currently 950+ LinkedIn followers; more than 50% are practitioners). As an AIR-Q co-president, I wish to organise discussions and seminars with high profile speakers delivering industry knowledge first-hand. In doing so I hope to boost members' business and technical acumen and help them gain an edge while looking for jobs.

My course

The MSc Actuarial Management course is a springboard for students to focus on technical and soft skills while aiming for exemptions from some professional examinations from the Institute of Actuaries (IFoA). The course is split into three terms; the 1st and 2nd terms cover the CPs and SPs whereas the 3rd term gives students an opportunity to dive deeper or widen their knowledge. My interest lies in non-life insurance with a particular emphasis on how to employ technology to further improve non-life actuarial methods. Equipped with my computer engineering background and consistent learnings from the Business School, I plan to perform research in data science techniques that could be used by insurers.

The Event

As such, with the growing potential of technology, actuaries are turning to data science and artificial intelligence. In this talk, we dived deeper into the mind of a data science actuary; Hash Piperdy, Managing Director of Epitome. The event began with Hash noting the increase in digitization and addressing an important question.

“33% of roles across financial services sector are predicted to be highly impacted by digitization over next 3-5 years. What does this mean for actuaries?”

He suggested that a broader skillset across data science allows actuaries to move into new areas, and provide even more valuable business insights.

Hash spoke about the overlap and differences in terms of skills, approach and toolkits between actuaries and data scientists. He then walked us through the Gartner hype curve and definitions of key terms such as Machine Learning, Artificial intelligence and Deep Learning.

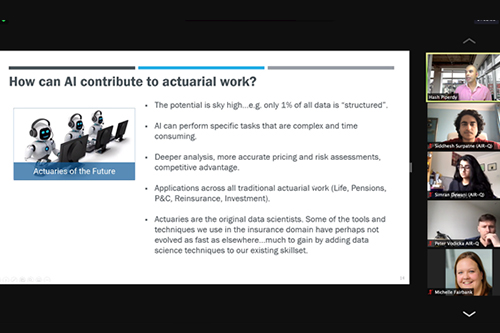

He moved onto discussing the main focus of the event - how can Artificial Intelligence contribute to actuarial profession. This included some practical cases:

- Motor pricing and GI reserving: Adoption of gradient boost machines and artificial neural networks

- Credit risks calculations in banks: Deploying robotic process automation and identifying ‘bad risks’

- Life Insurance / Pensions: Data mining to detect weaknesses of mortality models based on real data

- Fraud Claims management: Improving processes to better detect fraud as well as speedier settlements, and better customer service

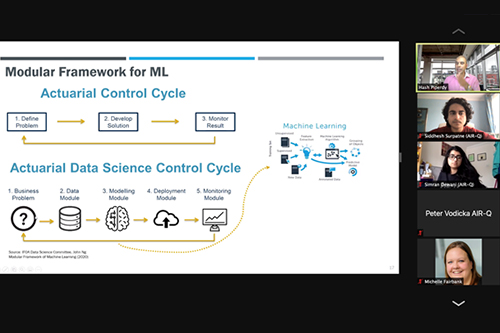

Further he pointed out how the “Actuarial Data Science Control cycle” is deployed and how it is differs from the traditional “Actuarial Control Cycle”. He concluded by describing 4 case studies in detail:

- Image recognition: This uses neural networks. Achieving desired accuracy is hard as vast amounts of data are needed to train the model. Simple identification/classification isn’t enough for insurance applications as we need to connect features together for e.g. multiple areas and magnitude of damage for accident damage.

- Fraud Management with artificial intelligence: Actuaries are ideally placed to support IT colleagues to develop and build these applications. There are some challenges to think about (other than data quality and systems integration issue) for example, commercially we need to find a balance, just looking at “Accuracy” is not optimal.

- Motor pricing: There have been particular discussions with which technique is suitable to price motor insurance - artificial neural networks, gradient boost machines or a hybrid of both. It is encouraged to experiment with your own data to get comfortable with which new techniques to adopt.

- Customer sentiment using NLP: Introduces the role of data science in customer centric insurance. This includes text mining, rule based approaches (Stemming, tokenization, part-of-speech tagging and parsing, Lexicons (i.e. lists of words and expressions)) classification.

The AIR-Q society was honoured to have Hash share his insights with us, and we would like to extend our sincere gratitude to him.

Follow AIR-Q society to join us for future events:

AIR-Q events on Campus groups

AIR-Q LinkedIn page

AIR-Q Instagram page

The founder and presidents of AIR-Q society (Peter V (PhD Actuarial Science), Ruby Ison (MSc Mathematical Trading and Finance), Harry Parker (MSc Financial Mathematics), Mihir Agarwal (BSc Actuarial Science), Simran Dewani (MSc Actuarial Science) and Siddhesh Surpatne (MSc Actuarial Management)) would like to thank the Business School (formerly Cass) careers and events team for their help in setting up a successful webinar. Many thanks to the participants, and especially the speaker for his knowledge sharing session regarding the latest data science techniques used in the actuarial work. We hope to host such events of high quality in the future.