Research uncovers the factors that determine organisational insurance demand

Research from Dr Simone Krummaker, Senior Lecturer in Insurance at Cass Business School has uncovered eight factors that influence an organisation’s level of risk aversion, and its likely demand for insurance.

Dr Krummaker’s paper, ‘Firm’s demand for insurance: An explorative approach’, examined the main influences of insurance demand and the decision-making process for owners and management.

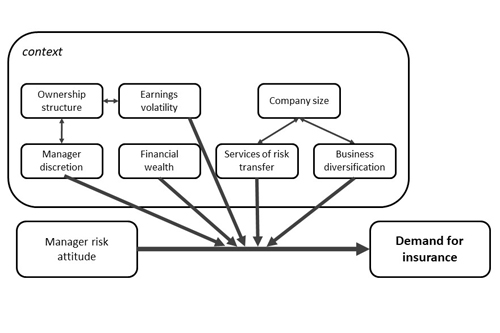

The study used a combination of interviews, documents and press cuttings for organisations of different sizes and industries. Research analysed interdependent relationships between a series of factors to devise a model based on the following variables:

- Managerial risk aversion: the decisive factor in determining an organisation’s demand for insurance is the decision-maker’s individual attitude towards risk. This attitude to risk can however be influenced by several conditions below.

- Ownership structure of the organisation: is it a sole propriety where insurance demand is determined by the risk preference of its owner, or is it a larger company which dictates the discretion of its managers depending on the level of investor involvement?

- The size of an organisation: larger organisations may have organised departments for handling insurance matters, risk and claim assessments – which could mean lower insurance demand – whereas smaller firms may not have capacity for this in-house and enlist the services of an insurer.

- Diversification of activity in an organisation: organisations that have greater scope for diversification – both in the scope of its business activities and geographical bases – are therefore able to mitigate risk without high demand for insurance. It is larger organisations that tend to enjoy this scope for diversification, and therefore have lower insurance demands.

- Financial strength of an organisation: organisations in strong financial positions can pay higher excesses and use internal sources of risk financing that lower their demand for insurance.

- Volatility of earnings: organisations with highly volatile earnings – such as dependence on seasonality – are more likely to demand insurance to cover potential shortfalls in the balance sheet. The extent to which volatility of earnings is managed through insurance depends on the ownership structure of an organisation, with a wider spread of ownership typically demanding more insurance.

- Taxation levels were not found to have any effect on an organisation’s demand for insurance.

Dr Krummaker said her findings could help company bosses become more aware of their need for insurance services against other measures of risk mitigation, as well as considering their own attitudes towards risk.

“Insurance plays a significant role in company risk management strategies, but beyond legal requirements there is little attention paid as to where and to what extent it is necessary."

“Risk aversion explains why we take out insurance as individuals, but the picture for companies is clouded by their differences in size, financial clout, activities, and structure,” she said.

Dr Krummaker also believes that the research could inform insurance providers and help them to tailor insurance packages towards individual companies to match their likely needs.

“Insurance can be a tricky issue for organisations – particularly less established ones in the current economic climate. Understanding what it is that influences the insurance and risk management choices of organisations can help insurers attract the right ones, and in turn allows organisations to confidently mitigate risk without accumulated unwarranted costs”.

‘Firm’s demand for insurance: An explorative approach’ is published in Risk Management and Insurance Review.