How ship tracking systems can improve our understanding of freight rate evolution

Study is the first to use a capacity measure derived from ships' radio signal data to explain the evolution in voyage charter freight rates.

Tanker freight markets are of enormous importance, being central to the distribution of crude oil – one of the most actively traded commodities in the world, and the largest component of global energy consumption.

The international trade of crude oil determines the demand for tanker services. The tanker shipping industry itself is cyclical, highly volatile, and characterised by sudden fluctuations in freight rates, which are often attributed to short-term fluctuations in the balance between supply and demand. This can be problematic for freight market participants and poses significant challenges for the management of their freight rate risk.

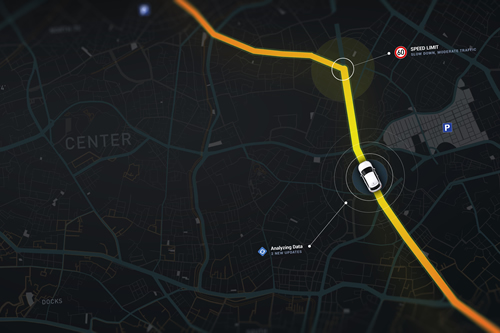

Recently however, it has become possible to track the movement of vessels via radio signals sent by Automatic Identification Systems (AIS). AIS is an automatic tracking system that uses transponders on ships that send a signal to satellite and land-based stations indicating the location, heading, speed and destination of a cargo ship. This is a system that is mandated by Maritime authorities to assist vessels in case of an accident or other emergency. In fact, the International Maritime Organisation made it mandatory for vessels engaged on international voyages to have an AIS transponder on board.

In addition to the practical use for the purposes of safe navigation, AIS based information is also commercially valuable as it enables to track vessel movements on a real-time basis, and so provides up-to-date information about vessel supply. One can see on a real-time basis the location of each vessel, her speed and destination, thus providing a very detailed view about the supply side of freight markets.

To conduct this research, the authors of the paper The eye in the sky – Freight rate effects of tanker supply processed and analysed AIS data made available by Marine Traffic. The data contained information about the location of each tanker vessel at varying frequencies, ranging from a few minutes to hours. This resulted in very large datasets that needed to be analysed and screened using big data techniques.

The study focuses on the voyage charter market for very large crude oil carriers (VLCC) which refers to oil tankers with a capacity of about 270,00 metric tons dead-weight (mt dwt). The authors examined a very specific segment of this market, namely the market for VLCC cargoes between the Arabian Gulf and the Far East; this is the most important crude oil seaborne trade route as about one third of the global trade in crude oil takes place in this route.

The information of vessel movement, albeit very useful, needs to be combined with information about the trading status of each vessel: i.e. whether the vessel has secured her next cargo or not, as well as the position when the trading status of the vessel changes. To do that the authors superimposed data on the location of the vessel with data on the trading status of the vessel.

By combining AIS data with information on vessel fixtures, the authors propose a novel measure of available short-term capacity. The proposed capacity measure adds to the freight rate price discovery above and beyond what is already explained by other market variables. The findings suggest that AIS measures can explain elements of the freight rate evolution, which are not already explained by traditional supply and demand measures or Forward Freight Agreement (FFA) contracts. It finds that the evolution of freight rates depends on the fleet’s geographical distribution as well as its employment status.

The economic impact of the proposed measure is significant. It appears that a one standard deviation decrease in the capacity measure, i.e. 2.2 percentage points decrease or about 14 VLCC vessels, results in an increase in freight rates of approximately 3.75%.

The results have implications for practitioners and academics alike. First, the proposed measure of tonnage availability is a potentially useful indicator of shipping economic activity and, as such, may be used more widely by both practitioners and academics as a freight rate forecast indicator and a proxy for trading and physical market activity. Furthermore, the use of fixtures information also provides insights on the spatial chartering pattern of market participants.

Building on this paper, future research might look at the interplay between freight rates and AIS based measures in longer sample periods and other commercial shipping segments.

The paper has been published in Transportation Research. A copy may also be downloaded at City Research Online.