Seminars and Events

Fourteenth Annual Mergers and Acquisitions Research Centre (MARC) Outlook for M&A Event

- Stephen Pick, UBS

- Russell Enright, SS&C Intralinks

- Edward Little, Ardian

- Lucinda Gutherie, Mergermarket - ION Analytics

- Jana Mercereau, Willis Towers Watson

- Liz Claydon, KPMG.

Register now and find out more.

Eighth Annual Mergers and Acquisitions Research Centre Conference

Conference date: Tuesday 18 June 2024

Location: London, UK.

Following the success of the seventh conference in 2023, we are pleased to announce that the Eighth Mergers and Acquisitions Research Centre (MARC) Conference will be held at Bayes Business School, City, University of London on Tuesday 18 June 2024, again in cooperation with the European Corporate Governance Institute (ECGI).

The conference organizers invite authors to submit original, theoretical and empirical papers covering issues related to mergers and acquisitions (M&A), including topics such as deal structure from financing to integration, activism, regulatory changes, domestic and cross border transactions and corporate social responsibility among others.

Paper submission

The submission deadline is 19 January 2024 at 10pm GMT (United Kingdom time). There is no submission fee. To be eligible for submission, the paper must still be at a revisable stage (i.e. neither forthcoming nor close to being accepted at a journal) by the date of the conference. Please email a pdf version of your paper to BayesMARC@city.ac.uk. The file name must be: [presenting author’s last name]_[shortened paper title] (for example, Smith_Deal integration.pdf). Please include “MARC2024” in the subject of your email. We expect to notify authors about acceptances by 27 March 2024.

Structure

Sessions will take place between 8:30am and 5:30pm on Tuesday 18 June 2024 with a keynote speech during lunch and reception following the conference. The conference will be held in-person at Bayes Business School, and all presenters and discussants are expected to attend in-person. The conference dinner for presenters, discussants, and program committee members will be held on Monday 17 June 2024 before the conference opening.

Programme committee

Kenneth Ahern (University of Southern California), Marco Becht (Université libre de Bruxelles & ECGI), Audra Boone (Texas Christian University & ECGI), Claudia Custodio (Imperial College & ECGI), Éric de Bodt (Université Lille), B. Espen Eckbo (Dartmouth College & ECGI), Eliezer Fich (Drexel University & ECGI), Andrey Golubov (University of Toronto & ECGI), Jarrad Harford (University of Washington & ECGI), Tim Jenkinson (University of Oxford & ECGI), Dirk Jenter (London School of Economics & ECGI), Kai Li (University of British Columbia & ECGI), Song Ma (Yale University), Ronald Masulis (University of New South Wales & ECGI), Micah Officer (Loyola Marymount University), Robert Parrino (University of Texas at Austin), Raghavendra Rau (University of Cambridge), Stefano Rossi (Bocconi University & ECGI), Henri Servaes (London Business School & ECGI), Denis Sosyura (Arizona State University), Sudi Sudarsanam (Cranfield University), Karin Thorburn (Norwegian School of Economics & ECGI).

About MARC

The M&A Research Centre, founded in 2008, is a breakthrough - the first time a major business school has established a focused centre for research into the global M&A industry. With its proximity to the City of London, Bayes is perfectly placed to maintain close contacts with M&A bankers, lawyers, consultants, accountants and other key players. MARC is one of 18 research centres at Bayes. A number of corporations, regulators, professional services firms, exchanges and universities have been using MARC for swift access to the latest research and practical ideas. MARC is proud to have its Sponsors, Ardian, BP, ION Group (Mergermarket), ICAEW, SS&C Intralinks, UBS (formerly Credit Suisse) and WTW (Willis Towers Watson) as research partners. In 2011, MARC was chosen by AACSB to be the 'Spotlight' feature in its Research/Scholarship Resource Centre.

Link to article: Spotlight: City University, London - September 2011

Conference organisers

Prof Scott Moeller, Prof Anh Tran, and Prof Paolo Volpin

Past events

Seventh Annual Mergers and Acquisitions Research Centre Conference

The Mergers & Acquisitions Research Centre at Bayes Business School and the European Corporate Governance Institute (ECGI) hosted the Seventh Annual M&A Research Centre Conference at Bayes Business School, London.

Sessions took place between 8:30am and 5:30pm on Monday 19 June 2023. The keynote speech “What’s ‘the Deal’: What’s happened, what’s happening and what may happen - Market insights from the WTW M&A Barometer Survey” was delivered by Amanda Scott, Global Mergers & Acquisitions Leader at WTW. The conference was attended by academics, PhD students and alumni.

Read more about the conference – click here.

Conference Programme:

To view the conference programme – click here.

*(Author name in bold denotes presenting author)

Title: “Scope, Scale, and Concentration: The 21st century firm”

Authors: Gerard Hoberg (University of Southern California) and Gordon M. Philips (Dartmouth College) Abstract: We provide evidence that over the past 30 years, U.S. firms have expanded their scope of operations. Increases in scope and scale were achieved largely without increasing traditional operating segments. Scope expansion significantly increases valuation and is primarily realized through acquisitions and investment in R&D, but not through capital expenditures. We show that traditional concentration ratios do not capture this expansion of scope. Our findings point to a new type of firm that increases scope through related expansion, which is highly valued by the market.

Title: “Merger Waves and Innovation Cycles: Evidence from Patent Expirations”

Authors: Matthew Denes (Carnegie Mellon University), Ran Duchin (Boston College) and Jarrad Harford (University of Washington) Abstract: We investigate the link between innovation cycles and aggregate merger activity using data on patent expirations. We focus on patents that expire due to term expirations, which mandatorily occur at a pre-specified date. We find strong clustering in industry patent expirations (“patent expiration waves”). These patent waves trigger industry merger waves with lower announcement returns and worse long-term performance for acquirers, but higher announcement returns and larger premiums for targets. Acquirers also experience declines in profit margins, cash holdings and investment opportunities, while cutting costs in the year prior to a merger. Overall, we put forth a link, unexplored in the literature, between merger waves and patenting activity.

Title: “Solving Serial Acquirer Puzzles”

Authors: Antonio Macias (Baylor University), P. Raghavendra Rau (University of Cambridge) and Aris Stouraitis (Hong Kong Baptist University) Abstract: Using a novel typology of serial acquirers, we examine several puzzles documented in prior literature. We show that acquisitions by different types of acquirers are driven by different factors, they acquire different sizes of targets, and subsequent acquisitions by acquirers are predictable ex ante. Controlling for market anticipation, the most frequent serial acquirers do not earn declining returns as they continue acquiring, while less frequent acquirers do. Our methodology enhances our understanding of serial acquisition dynamics, anticipation, and economic value adjustments. The methodology is likely to be relevant to topics related to event anticipation beyond those covered in this study.

Title: “The use of escrow contracts in acquisition agreements”

Authors: Sanjai Bhagat (University of Colorado), Sandy Klasa (University of Arizona) and Lubomir Litov (University of Oklahoma) Abstract: A large fraction of acquisition deals for private firm and subsidiary targets include an escrow contract giving the bidder the opportunity to lay claim on escrow account funds if subsequent to the acquisition the seller fails to meet specific acquisition agreement terms. The likelihood of using an escrow contract is higher when buyer or seller transaction risk is larger. Also, the use of escrow contracts (i) helps to reduce bidders’ due diligence costs, (ii) enables sellers to obtain a higher sale price, and (iii) raises the extent to which an acquisition leads to an increase in bidder firm shareholder value.

Title: “The Incentives of SPAC Sponsors”

Authors: Felix Feng (University of Washington), Tom Nohel (Loyola University, Chicago), Xuan Tian (Tsinghua University), Wenyu Wang (Indiana University) and Yufeng Wu (University of Illinois) Abstract: The market of Special Purpose Acquisition Companies (SPACs) has exploded in recent years, yet its volatile performance calls into question the implications of this unique business model and particularly the incentives of the SPAC sponsors on the welfare of SPAC shareholders. This paper quantitatively studies these questions by estimating a model featuring the strategic interactions between SPAC sponsors, targets, and investors. The estimation uses a comprehensive hand-collected dataset of SPACs that completed acquisitions by the first quarter of 2022 with rich information such as sponsor concessions, earnouts, redemptions, etc. Agency costs

appear pervasive: the inter-quintile range of returns to non-redeeming shareholders reaches 19% in deals sorted by their degrees of agency conflicts. Average SPAC investors make sizable mistakes in inferring deal quality. Tying more of the sponsor’s promote shares to earnouts and improving the transparency of information significantly reduces the agency cost and improves investors’ expected return, while cutting back the issuance of warrants has a limited impact on the average SPAC investors’ welfare.

Title: “Tax Avoidance through Cross-Border Mergers and Acquisitions”

Authors: Jean-Marie Meier (University of Texas) and Jake Smith (University of Texas) Abstract: We investigate 13,307 cross-border, tax-haven mergers and acquisitions (M&A) from 1990 to 2017, totalling $4.1 trillion in deal value, or about 30% of total cross-border M&A volume. $2.4 of the $4.1 trillion is beyond what is predicted based on a gravity model with economic fundamentals. Tax-haven M&A result in $31.6 billion in recurring annual tax avoidance. To illustrate the magnitude, for a US firm with no prior cross-border M&A history, buying an Irish firm worth 5% of its total assets would result in an expected decline in its effective tax rate of 3.56 percentage points. For identification, we use a change in US tax law in 2004. Following haven acquisitions, firms are more likely to relocate their headquarters to havens. Our results document that tax avoidance through havens is a significant determinant of cross-border M&A.

Title: “Beyond Culture: How does international migration affect cross-border mergers and acquisitions?”

Authors: Ning Gong (Deakin University), Micah Officer (Loyola Marymount University) and Hong Feng Zhang (Deakin University) Abstract: We show that a higher migrant stock from an acquiring country to a target country leads to greater deal frequency and dollar value in cross-border acquisitions after controlling for the differences in economic and financial development, regulatory environments, valuations, and cultural distance. Our results support the arguments that migration impacts cross-border deal activity by ameliorating the effect of cultural distance, facilitating post-merger integration, and mitigating information asymmetry between acquiring and target countries. Instrumental variables derived from the interactions of the push and pull factors of migrant flows mitigate endogeneity concerns in our study.

Outlook for M&A 2023

The Mergers & Acquisitions Research Centre (MARC) at the Bayes Business School hosted its 13th Annual Outlook for M&A on Monday, 23 January 2023.

Each year the Business School brings together leading experts in mergers and acquisitions to discuss recent global activity in the markets and predict the landscape for the year ahead. 2022 has set new records but is very different from the expectations of early in the year when the news was all about when lockdowns would end and whether the activity in SPACs would continue. The expert panel will discuss the direction of the market for 2023 from the perspective of which industries and regions will be strong and whether the general activity levels will remain high as interest rates rise.

The event was introduced by Professor Scott Moeller, Director and Founder of the M&A Research Centre with more than 100 participants attending, the audience included students, alumni, practitioners and journalists.

This year’s expert panel was chaired by Susan Kilsby, Advisory Board Chair of the M&A Research Centre and former Chair of Shire Pharmaceuticals. Susan was joined by five experts from the industry, including Cyril Auger (Ardian), Lucinda Gutherie (Mergermarket / ION Analytics), William Mansfield (Credit Suisse), Amanda Scott (Willis Towers Watson) and Matt Wells (S&SC Intralinks).

To view the programme click here.

A link to the write-up of the event can be found at: Experts warn of tougher times ahead.

Sixth Annual Mergers and Acquisitions Research Centre Conference

The Mergers & Acquisitions Research Centre at Bayes Business School and the European Corporate Governance Institute (ECGI) hosted the Sixth Annual M&A Research Centre Conference at Bayes Business School, London.

Sessions took place between 8:30am and 5:30pm on Monday 27 June 2022 and we had to revise the format of the conference. Instead of being able to meet in-person we offered an online streaming option as well.

The keynote speech “H2 trends on M&A, debt issuance and fund raising” was delivered by Giovanni Amodeo, Chief Data Officer at ION Analytics/Mergermarket The conference was attended by academics, PhD students and alumni.

Programme:

To view the conference programme please click here.

*(Author name in bold denotes presenting author)

Title: “Does Regulatory Exposure Create M&A Synergies?”

Authors: Eliezer Fich (Drexel University), Tom Griffin (Villanova University) and Joseph Kalmenovitz (Drexel University)

Abstract:

We study the impact of regulation on acquisition investment, using a novel firm-level measure of exposure to all federal regulations. Highly regulated companies issue more acquisition bids, invest more in those transactions, and earn higher M&A announcement returns. Moreover, highly regulated acquirers exhibit better long-term performance, greater M&A synergies, and a significant reduction in their regulatory exposure after merger completion. The benefits are stronger in deals with small transaction values and in those involving private targets. Overall, our findings uncover a new link between M&A and regulation, highlighting synergy opportunities which materially affect corporate investment choices.

Title: "The (Un)intended Consequences of M&A Regulatory Enforcements”

Authors: Jean-Gabriel Cousin (Université de Lille), Eric de Bodt (Norwegian School of Economics), Micah Officer (Loyola Marymount University) and Richard Roll (California Institute of Technology)

Abstract:

Economic and policy uncertainty affect merger and acquisition (M&A) activity. In this paper, we use Department of Justice (DOJ) and Federal Trade Commission (FTC) interventions in the M&A market to investigate whether uncertainty around regulatory enforcements also matters. Our results support this conjecture. Using the Hoberg and Phillips (2010) similarity scores to identify product market competitors, we confirm a clear and significant DOJ/FTC regulatory enforcements’ deterrence effect on future M&A transaction attempts, a result robust to many alternative specifications and confirmed in additional tests. This deterrence effect is (at least partly) driven by the length of the regulatory process, a factor that exacerbates enforcement uncertainty. Our results identify an (un)intended channel through which M&A regulation hampers efficient resources allocation.

Click here to watch the first session recording.

Title: “Winner’s Curse in Takeovers? Evidence from Investment Bank Valuation Disagreement”

Authors: Tingting Liu (Iowa State University), Tao Shu (Chinese University of Hong Kong) and Jasmine Wang (University of Virginia)

Abstract:

Existing literature debates the existence of the winner’s curse in mergers and acquisitions, a phenomenon in which the winning bidder fails to account for the uncertainty about the target value and thus overpays for the acquisition. Using a unique setting where target firms hire multiple investment banks as advisors, we construct a novel measure of target valuation uncertainty based on the disagreement of investment banks on target valuation. We find that in the presence of high valuation disagreement, bidders on average pay significantly higher acquisition premiums, and bidders who pay higher premiums have lower returns around merger announcements and in the long run. These bidders also create lower merger synergies. Our results are robust to the control for selection bias using Heckman two-stage model with an exclusion restriction. Moreover, the winner’s curse is more pronounced when bidders have overconfident CEOs. Overall, our findings suggest that the winner’s curse does exist in takeovers and causes distortions in resource allocation.

Title: "Mergers under the Microscope: Analyzing Conference Call Transcripts”

Authors: Sudipto Dasgupta (Chinese University of Hong Kong), Jarrad Harford (University of Washington), Fangyuan Ma (Peking University), Daisy Wang (Ohio State University) and Haojun Xie (Chinese University of Hong Kong)

Abstract:

Many M&A deal announcements are accompanied with a conference call to discuss deal details and address market participants’ demand for information. We find that calls are associated with positive market reactions and a higher likelihood of deal completion. Using a topic modelling approach, we uncover 20 highly interpretable topics from the call transcripts. Market reactions are more (less) positive when the call communicates more “hard” (“soft”) information, revealing different disclosure strategies depending on deal quality. Governance-related issues, although not significantly correlated with stock returns, are prominently discussed and related to the latent motivation for holding calls.

Click here to watch the second session recording.

Title: “Post-merger Restructuring of the Labor Force”

Authors: Britta Gehrke (University of Rostock), Ernst Maug (University of Manheim), Stefan Obernberger (Erasmus University) and Christoph Schneider (University of Münster)

Abstract:

We study the restructuring of the labor force after M&As. Restructuring is large. Net employment of targets declines by half within two years after acquisitions relative to matching firms. Employee turnover increases, particularly for managers, and jobs

migrate to acquirers. Acquirers have a better-educated, better-paid, and more qualified workforce than targets. Acquirers hire new employees who are younger and less expensive than those who leave. Some mergers create internal labor markets, especially for highly-paid employees, but most hiring is external. Our results are consistent with a framework in which acquirers seek business opportunities from targets and provide the organizational and managerial capacity to produce more efficiently.

Click here to watch the third session recording.

Title: "Climate Laws and Cross-border Mergers and Acquisitions”

Authors: Dragon Yongjun Tang (University of Hong Kong) and Tong Li (University of Hong Kong), Fei Xie (University of Delaware)

Abstract:

Governments are increasingly concerned about climate-related risks and taking measures to curb the worsening of climate change. We find that a country’s adoption of climate laws reduces cross-border mergers and acquisitions targeting firms in the country. This finding is especially pronounced for firms more exposed to climate regulations, in countries with stronger legal enforcement, and after the Stern Review and the Paris Agreement. Moreover, announced takeover bids from foreign acquirers are more likely to be withdrawn and deal synergy and offer premium decrease after the target country adopts climate laws. Overall, our findings suggest that national climate regulations can affect international capital flows and resource reallocation.

Title: “The Innovation Arms Race”

Authors: Muhammad Farooq Ahmad (SKEMA Business School) Eric de Bodt (Norwegian School of Economics) and Jarrad Harford (University of Washington)

Abstract:

Economists have long recognized that competition and innovation interact as key drivers of economic growth (Schumpeter, 1943; Arrow, 1962; Aghion and Howitt, 1992). Acknowledging this, regulators carefully scrutinize competitive behaviors that potentially affect innovation incentives, in particular in the case of proposed mergers (Shapiro, 2012). Do acquisitions of innovative targets spur or stifle innovation? To address this question, we provide a first large scale empirical investigation of M&A effects on acquirer rivals’ incentives to innovate and the equilibrium outcome resulting from this competitive process. Our results are consistent with an innovation arms race: acquisitions of innovative targets push acquirer rivals to invest more in innovation, both internally through research and development (R&D) and externally through acquisition of innovative targets, and this increase in innovation investment necessary to maintain competitive position leads to a decrease in firm market valuation. These results are robust to endogeneity and are driven by the High-Technology industry. This arms race process appears stronger for leaders and neck-and-neck firms. Initial patents and patent citations based evidence shows no sign of innovation investment efficiency decline, suggesting that the innovation arms race generates a transfer of economic rent favorable to consumers.

Click here to watch the fourth session recording.

Outlook for M&A in 2022

The Mergers & Acquisitions Research Centre (MARC) at the Business School hosted its 12th Annual Outlook for M&A on Monday, 24 January 2022.

Each year the Business School brings together leading experts in mergers and acquisitions to discuss recent global activity in the markets and predict the landscape for the year ahead. 2021 has set new records but is very different from the expectations of early in the year when the news was all about when lockdowns would end and whether the activity in SPACs would continue. The expert panel will discuss the direction of the market for 2022 from the perspective of which industries and regions will be strong and whether the general activity levels will remain high as interest rates rise.

The event was introduced by Professor Scott Moeller, Director and Founder of the M&A Research Centre with more than 100 participants joining virtually, the audience included students, alumni, practitioners and journalists.

This year’s expert panel was chaired by Susan Kilsby, Advisory Board Chairman of the M&A Research Centre and former chair of Shire Pharmaceuticals. Susan was joined by four experts from the industry, including Cyril Auger (Ardian), Cathal Desay (Credit Suisse), Marie-Laure Keyrouz (Mergermarket) and Matt Wells (S&SC Intralinks).

A link to the write-up of the event can be found at: Experts predict another strong year ahead at Outlook for M&A 2022 | Bayes Business School (city.ac.uk)

Watch the recording the Outlook for M&A 2022 event.

Fifth Annual Mergers and Acquisitions Research Centre Conference

The Mergers & Acquisitions Research Centre at Bayes Business School and the European Corporate Governance Institute (ECGI) hosted the Fifth Annual M&A Research Centre Conference at Bayes Business School, London.

Originally scheduled for June 2020, this event was postponed due to the coronavirus pandemic. Sessions took place over two consecutive days on Monday 28 June and Tuesday 29 June 2021. Due to the pandemic situation, we had to revise the format of the conference. Instead of being able to meet in-person, we moved to an online format. In addition to the paper presentations and discussions, we organised break-out rooms to enable small group interactions.

The keynote speech “Corporate M&A: A proven value-creation strategy” was delivered by Rick Faery, Head of Corporate Insights Group at Credit Suisse Investment Bank. The conference was attended by academics, PhD students and alumni.

For a write up of the event click here.

Programme

*(Author name in bold denotes presenting author)

Title: “Hiring high-skilled labor through mergers and acquisitions”

Authors: Jun Chen (Renmin University), Shenje Hshieh (City University of Hong Kong) and Feng Zhang (University of Utah)

Abstract:

In two natural experiments based on H-1B visa lotteries and a drastic cut in the annual H-1B visa quota, we document that firms respond to shortages in high-skilled workers by acquiring target firms that have these workers. Additional tests show that desire for the target’s skilled workers is an important driver of these acquisitions. Acquirers that successfully obtain skilled workers from their targets outperform acquirers that withdraw their acquisition bids for exogenous reasons. Our findings suggest that skilled labor is a driver of acquisition decisions and a source of synergy gains.

Title: “Security design for the acquisition of private firms”

Authors: Mark Jansen (University of Utah), Thomas Noe (University of Oxford) and Ludovic Phalippou (University of Oxford)

Abstract:

We propose a security design model in which a potential acquirer approaches a firm with a value-add plan. The target has a single owner, who possesses private information: he knows whether his firm is compatible with the plan, or not. The seller agrees the acquirer will add value but not as much as what the acquirer expects. Although the acquirer can choose any monotone limited liability security to offer along with cash, we show that, under general conditions, if a security is employed, it takes the form of non-recourse junior debt provided by the seller.

Click here to watch the first session recording.

Title: “Acquisitions and CEO compensation changes”

Authors: Leonce Bargeron (University of Kentucky) and David Denis (University of Pittsburgh)

Abstract:

Increases in CEO compensation following acquisitions are unique to stock-financed deals. These compensation increases are driven by increases in equity-based compensation, and are concentrated in riskier acquirers, riskier deals, and in acquirers whose CEOs have low exposure to the stock price. These findings support the Dual Adverse Selection Hypothesis, which posits that acquirers use stock to overcome adverse selection in the target firm, while increasing the equity-based compensation of the acquirer CEO to mitigate adverse selection concerns on the part of target shareholders. We find little support for the hypothesis that acquisition-related increases in CEO compensation are due to entrenched, empire building CEOs.

Title: "Are managers listening to Twitter? Evidence from Mergers & Acquisitions”

Authors: Christoph M. Schiller (Arizona State University)

Abstract:

This paper studies the feedback effects of social media on corporate investment decisions. Using a comprehensive sample of millions of tweets from a popular social media network, I show that negative social media feedback around the announcement of a corporate acquisition increases the likelihood that the M&A deal is subsequently withdrawn, especially when the relevant tweets have a higher prominence and visibility, and when the acquiring firm’s stock has low price informativeness. This effect is not subsumed by the announcement returns of the acquiring and target firm or the reaction to the M&A announcement in traditional news media. Managers use feedback from social media as a substitute for other sources of information to help guide their investment decisions.

Click here to watch the second session recording.

Title: “EPS-Sensitivity and Mergers”

Authors: Sudipto Dasgupta (Chinese University of Hong Kong), Jarrad Harford (University of Washington) and Fangyuan Ma (Peking University)

Abstract:

Announcements of mergers very often discuss the impact of the deal on the acquirer’s earnings per share (EPS), especially when the deal is done in stock and is EPS-accretive for the acquirer. In this paper, we document that the acquirer’s EPS-sensitivity affects how deals are structured, the premium that is paid, and the types of deals that are done. We provide evidence that acquirer managers prefer to do avoid even minor EPS dilution when (a) shareholder approval is required for deals (b) institutional investor horizon is shorter, and (c) managers’ compensation is tied to EPS. We find that EPS-sensitivity is especially pronounced in the post-2001 period, when market overvaluation of the 1990s had disappeared and accounting rule changes no longer favored stock-financed acquisitions.

Click here to watch the third session recording.

Title: “Real effects of stock market valuations: Local valuation spillovers in M&A activity”

Authors: Anjana Rajamani (Erasmus University) and Frederik Schlingemann (University of Pittsburgh)

Abstract:

We document novel evidence of local valuation spillovers across a large sample of public firms during 1990-2019. Using a mutually exclusive stratification of subjects and local peers based on whether firms are from the most salient industries regionally, we document a strong positive association between firm-level acquisitiveness and exogenous variation in local peer valuations. Our measure for exogenous variation in local peers’ valuations does not rely on outflow-induced price pressures. We find evidence that

exogenous peer effects and correlated effects explain valuation spillovers in acquisitiveness, which suggests managers are unable to separate noise from information content in local peer valuations.

Title: “How do equity analysts impact takeovers?”

Authors: Eliezer Fich (Drexel University), Tingting Liu (Iowa State University) and Micah S. Officer (Loyola Marymount University)

Abstract:

Firms covered by more analysts are more likely to become takeover targets and more likely to enter deals in which their acquirers initiate private merger negotiations. Moreover, when equity analysts’ pre-acquisition price forecasts imply greater target undervaluation, target firms are more likely to initiate their own sale, takeover premiums are higher, those premiums tend to be revised upwards during private merger negotiations, and acquirer firms use less cash to structure the transaction. These results imply a material role for equity analysts during the M&A process: their coverage affects takeover probabilities while their price forecasts influence merger premiums and the merger consideration. Further, public bidders that acquire public targets with more analyst coverage experience an increase in their own coverage after the acquisition. Our findings support both investor recognition and information generation theories about the role of equity analysts in financial markets.

Click here to watch the forth session recording.

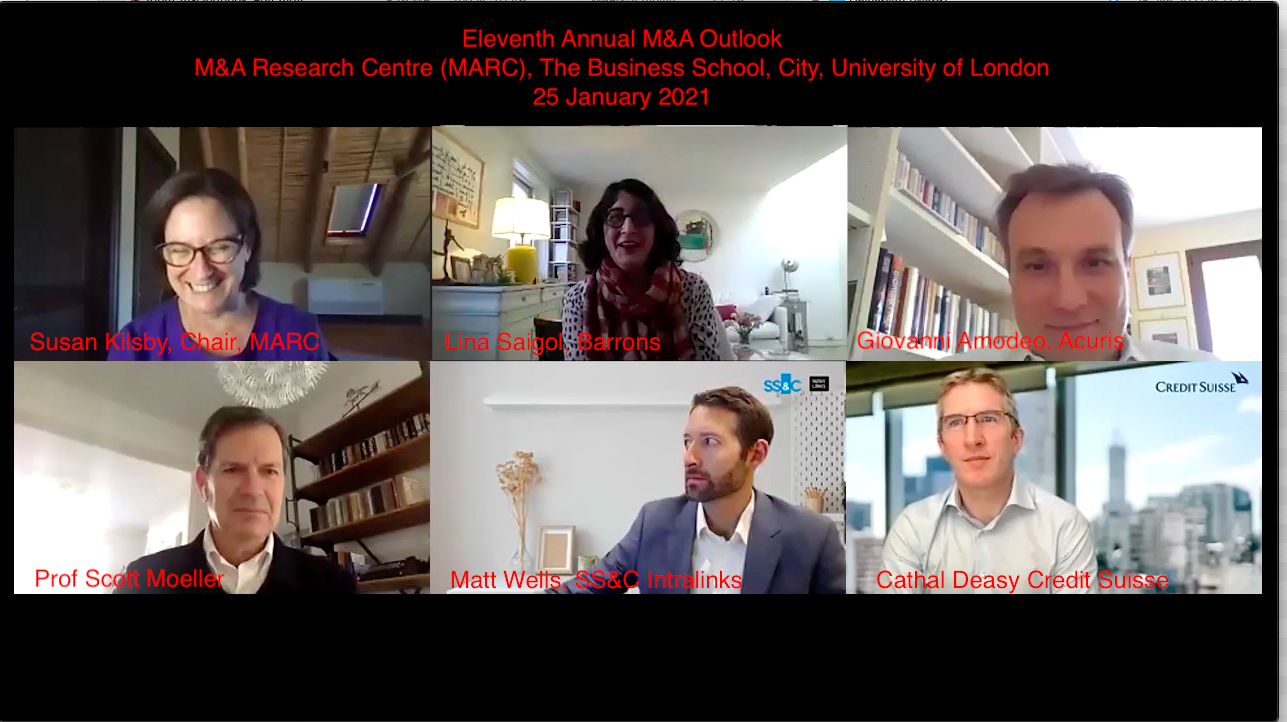

Outlook for M&A in 2021

The Mergers & Acquisitions Research Centre (MARC) at the Business School (formerly Cass) hosted its eleventh annual Outlook for M&A event on Monday 25th January.

More than 130 participants were in the virtual audience as Professor Scott Moeller, Director of MARC, welcomed students, alumni, practitioners and journalists to this year’s discussion, which was chaired by Susan Kilsby, Chair of the MARC Advisory Board.

Ms Kilsby was joined by experts from major sponsor organisations, including:

- Giovanni Amodeo, Chief Research Officer at Acuris

- Matt Wells, Vice President Global Product Marketing & Strategy at SS&C Intralinks

- Cathal Deasy, Head of M&A for EMEA at Credit Suisse

- Lina Saigol, Head of Corporate News, EMEA, Barron’s

To view the programme click here.

The event reviewed the last 12 months in the M&A market, highlighting the impact of the pandemic before a positive spike in activity during the latter quarter of the year, and outlined trends for 2021.

For a write up of the event click here.

Among topics discussed by the panel were patterns of Special Purpose Acquisition Companies (SPACs) compared with acquisitions and IPOs across the year, continued activity by activist investors, growth in protectionism, the significance of China and whether it was a good time for students to seek a career in M&A.

Watch the recording the Outlook for M&A 2021 event.

Webinar - The Code of the Rainmaker: how to win deals, harness networks and build relationships

Simon Brocklebank-Fowler, Founder and President of Firehouse Communications

The Business School (formerly Cass) welcomed Simon Brocklebank-Fowler to deliver the final Food for Thought Summer Series webinar of the academic year.

Click here to read the full article.

You can watch a full recording of the webinar via Youtube

An Evening with John Fingleton: a Discussion about the National Security and Investment Bill

Organised by the M&A/PE Society together with MARC, John Fingleton, former CEO of the Office of Fair Trading, discussed the UK Government’s National Security and Investment Bill. He spoke about why the Bill was being proposed and outlined the non-financial reasons behind political intervention in global mergers in acquisitions. The conversation was hosted by David Petrie, Head of Corporate Finance at the Institute of Chartered Accountants of England and Wales (ICAEW).

Click here to read the full article.

Outlook for M&A in 2020

The M&A Research Centre held a panel discussion and audience debate on 27 January 2020 at Bayes Business School (formerly Cass).

At the tenth annual Outlook for M&A event panelists dicussed predictions for the M&A market in 2020 with Bayes academics, industry practitioners from MARC's sponsor organisations and other leading companies. Panelists included speakers from Acuris (Mergermarket), Ardian, ICAEW, Intralinks and Willis Towers Watson.

The panel included:

- Chair: Alan Giles, Deputy Chairman, MARC Advisory Board

- Cyril Auger, Director, Ardian

- Professor Scott Moeller, Director of the M&A Research Centre, Bayes Business School

- David Petrie, Head of Corporate Finance, Corporate Finance Faculty, ICAEW

- Stephen Postill, Senior Director, Head of UK Pensions M&A Group, Willis Towers Watson

- Valeriya Vitkova, Research Fellow, M&A Research Centre, Bayes Business School

- John West, Managing Editor EMEA, Mergermarket

- Philip Whitchelo, Vice President for Strategic Business Development, Intralinks

The panel reviewed the 2019 market and discussed the effect of the likely global economic slowdown on deals in 2020. They also considered the impact of increased regulatory scrutiny in Europe, the opportunities for private equity and the role of governments and regulators in M&A.

Click here to read the full story

Bayes Innovate 2019: Ready. Set. Grow.

Professor Scott Moeller delivered a talk entitled 'What should a start-up do next? IPO, Acquisition or Dual Track' at the Bayes Innovate event which took place on 13 November 2019.

Click here for further information about the event

2019

Fourth Annual Cass Mergers and Acquisitions Research Centre Conference, 19 August 2019

The Mergers & Acquisitions Research Centre at Cass Business School and the European Corporate Governance Institute hosted the Fourth Annual M&A Research Centre Conference at Cass Business School, London.

Sessions took place between 8:30am and 5:30pm on Monday 19 August 2019. The keynote speech “Geopolitics in M&A” was delivered by David Petrie, Head of Corporate Finance at the Institute of Chartered Accountants in England and Wales (ICAEW). The conference was attended by academics, PhD students and alumni.

For a write up of the event click here

Programme

*(Author name in bold denotes presenting author)

Title:“The Anatomy of Acquirer Returns”

Authors: Olivier Dessaint (University of Toronto), B. Espen Eckbo (Dartmouth College) and Andrey Golubov (University of Toronto)

Abstract:

Largely constant average acquirer returns over the past four decades mask fundamental changes in the takeover market. Controlling for bidder composition, the common component of acquirer returns has increased by as much as five percentage points relative to the 1980s. Offsetting this increase, the average bidder-specific component has declined. The increase in the common component is pervasive and cannot be explained by learning, maturity, industry concentration, or improved corporate governance. However, better advisors may have contributed to this upward trend. Conceptually, the evidence is consistent with a general increase in merger synergies that have

become less bidder-specific over time.

Title: “Stakeholder Orientation and Firm Value”

Authors: Martijn Cremers (University of Notre Dame), Scott Guernsey (University of Cambridge) and Simone Sepe (University of Arizona)

Abstract:

This paper analyzes the relation between enhanced director discretion to consider stakeholder interests (“stakeholder orientation”) and firm value by considering the quasi-natural experiment provided by the staggered adoption of directors’ duties laws in 35 U.S. states from 1984 to 2006. We find that these laws result in significant increases in shareholder value, especially for firms that are larger, more complex or innovative and with stronger stakeholder relationships. Our results suggest that stakeholder orientation creates value for some firms by reducing contracting costs with stakeholders and mitigating the externalities stakeholders may bear due to conflicts of interests with shareholders.

Title: “Buyer Power and Horizontal Mergers: Evidence from Plant-Level Input Prices and Supply Contracts”

Authors: Mo Shen (Auburn University)

Abstract:

I study how firms achieve supply chain efficiency after acquisitions using comprehensive plant-level data on input prices and supply contracts. Using horizontal mergers between electric utility holding companies as an empirical setting, I find that input prices of coal-fired generation plants owned by merging firms decrease around 3-4% three years after merger completion. The procurement saving is mainly for target firms’ plants, for plants in deals with more positive stock market announcement effects, and for firms with stronger incentives to capture market share. The level of input price reduction is significantly related to the shareholders' wealth gains in the mergers. These findings are not driven by pre-merger input price trends and are robust to controlling for input quality, quantity, and changes in production technologies. Evidence from detailed supply contracts suggests that the merging firm actively renegotiates existing procurement contracts and shortens supply chain shipping distances upon merger completion. Subsequently, the quality of input used by the merging firms improves. Additionally, merging firms also actively seek new suppliers in the factor market. These results suggest that buyer power is an important source of shareholder wealth creation in horizontal mergers.

Title: “Acquisition Prices and the Measurement of Intangible Capital”

Authors: Michael Ewens (California Institute of Technology), Ryan Peters (Tulane University) and Sean Wang (Southern Methodist University)

Abstract:

We estimate a capitalization model for intangible assets - knowledge and organizational capital - with over 1,500 purchase price allocations from 1996 to 2017. This method provides the first empirical estimates of the amount of organizational capital, which we find comprises over 75% of the average firm's intangible assets. Our total implied intangible capital stocks are 10% smaller, on average, than those implied by commonly used parameters while exhibiting dramatically more cross-sectional variation. Compared with these existing methods, our stocks have stronger explanatory power for market valuations and firm-level measures of personnel risk. Other validation exercises | of the stocks' trends, correlations with patent quality and valuations, and ability to improve the investment-q relationship | demonstrate that the new estimates replicate or improve upon current approaches.

Title: “Time Zone Difference and Employee Coordination: Evidence from Mergers and Acquisitions”

Author: Zhaoran Gong (Lingnan University (Hong Kong))

Abstract:

I study the impact of time zone differences (TZDs) among firm segments on employee coordination in a mergers and acquisitions (M&A) setting. A model describing the synergy generated from real-time cooperation among employees suggests that TZDs impede employee coordination and reduce productivity. The model predicts negative market reactions to cross-time-zone M&A announcements. Using a sample of 3228 public M&A deals in the US, I find that the TZDs between acquirers and targets have a substantial negative effect on combined firm announcement returns: A one-hour TZD is associated with a decrease of 0.52-0.62% in the announcement return of the combined firm. Neither geographic distance nor cultural difference drives the negative effect. Consistent with the model predictions, the negative effect is stronger if the combining firms have high labor intensity or small employee numbers, or if they are similar in labor size or are in high-technology industries. I also find that, after cross-time-zone M&A, firms experience significant decline in operating performance and are more likely to conduct employee layoffs. Firms that conduct layoffs can recover their performance. Additional tests suggest that acquirers do not lower their offer price in cross-time-zone M&A and therefore, bear most

of the costs caused by TZDs.

Title: “Listing Gaps, Merger Waves, and the Privatization of American Equity Finance”

Authors: Gabriele Lattanzio (University of Oklahoma), William L. Megginson (The University of Oklahoma) and Ali Sanati (American University)

Abstract:

We document that the U.S. economy has experienced over the last 25 years sharply declining numbers of listed firms, extraordinary volumes of mergers and of private equity investments, and abnormally high aggregate valuations for U.S. listed corporations. We synthesize and empirically analyze these trends and their inter-connections and document the recent emergence of a new model of equity finance in the United States. We show that the listing gap identified by Doidge, Karolyi, and Stulz (2017) was caused by an unprecedented merger wave occurring between 1997-2001, which directly reduced the number of listed firms, and by the rise of the private equity industry, which curtailed new listings through IPOs. Our model of equity financing well explains changes in the number of listed U.S. firms before and after the 1997-2001 transition to a new equilibrium. We conclude that this new model of equity finance has yielded net financial and developmental benefits for the U.S. economy, although the merger waves have increased industrial concentration and the privatization of equity finance has almost certainly increased income inequality. We conclude by presenting preliminary evidence that this new model of equity financing is emerging in other developed countries.

Title: “Inside the “Black Box” of Private Merger Negotiations”

Authors: Micah Officer (Loyola Marymount University) and Tingting Liu (Iowa State University)

Abstract:

This paper enables a detailed look inside the “black box” of merger and acquisition (M&A) negotiations before the first public bid is announced. We find that bid revisions are very common in the pre-public phase of a deal, and that price revisions during the private negotiation window are associated with changes in the public-market values of the acquisition target. We also investigate whether the nature of the bid process has an impact on pre-public takeover price revisions and examine the strategic difference in biding in deals that are initiated privately by a bidder other than the winning bidder. We interpret our results as consistent with the notion that the behavior of target managers in the private negotiation window appears congruent with shareholder wealth maximization.

Cass M&A and PE Society Conference

On Tuesday 18 June 2019 the Cass PE and M&A Society hosted the 2019 Annual Cass PE M&A Conference at Cass Business School. The Lord Mayor of the City of London, Alderman Peter Estlin, delivered the keynote address and the Master of the Worshipful Company of International Bankers, Mark Sismey-Durrant,

also delivered an address. The event focused on technology and finance.

Fireside chat with Susan Kilsby

Cass Business School was delighted to welcome renowned business leader Susan Kilsby to Bunhill Row on Wednesday 9 May. Ms Kilsby spoke to title="Marianne Lewis" style="border-bottom: 1px solid rgb(204, 204, 204)">Professor Marianne Lewis, Dean of Cass Business School, about her career, leadership experience and her views on the current Mergers and Acquisitions (M&A) market. Ms Kilsby was formally introduced by

href="https://www.cass.city.ac.uk/faculties-and-research/experts/scott-moeller" title="Professor Scott Moeller" style="border-bottom: 1px solid rgb(204, 204, 204)">

Professor Scott Moeller

, Director of the Mergers and Acquisitions Research Centre (MARC).

Click here to read the full story

Outlook for M&A in 2019

The M&A Research Centre held a panel discussion and audience debate on 30 January 2019 at Cass Business School.

The ninth annual Outlook for M&A event heard predictions for the M&A market in 2019 from Cass academics, industry practitioners from MARC's sponsor organisations (Acuris, Ardian, ICAEW, Intralinks and Willis Towers Watson) and other leading companies.

The panel included:

- Chair: Susan Kilsby, Chairman, MARC Advisory Board

- Cyril Auger, Director, Ardian

- Jana Mercereau, GB M&A Practice Leader – Human Capital & Benefits, Willis Towers Watson

- Professor Scott Moeller, Director of the M&A Research Centre, Cass Business School

- David Petrie, Head of Corporate Finance, Corporate Finance Faculty, ICAEW

- John West, Managing Editor EMEA, Mergermarket

- Philip Whitchelo, Vice President for Strategic Business Development, Intralinks

The panel discussed the drivers that would impact the market during 2019, which included the impact of Brexit on transactions and on particular sectors; the rise of activism and its impact on the corporate world; and the impact of technology on M&A.

Although there was some disagreement on the panel of the direction of the market in 2019, most said the rise of the M&A and private equity markets since the last downturn was at a mature stage and more likely to pause or decline than increase for much longer.

Click here to read the full story

2018

Third Annual Cass Mergers and Acquisitions Research Centre Conference, 20 August 2018

The Mergers and Acquisitions Research Centre (MARC) at Cass Business School in cooperation with the European Corporate Governance Centre (ECGI) held the Third Cass Mergers and Acquisitions Research Centre Conference at Cass Business School, City, University of London.

Sessions took place between 8:30am and 5:30pm on Monday 20 August 2018. The keynote speech was delivered Philip Whitchelo, Vice President for Strategic Business & Corporate Development, Intralinks. The conference was attended by academics, PhD students and alumni.

Programme

Read the conference report summarising each presentation.

*(Author name in bold denotes presenting author)

Title: “Killer Acquisitions”

Authors: Song Ma (Yale University), Colleen Cunningham (LBS) and Florian Ederer (Yale University)

Abstract:

Firms may acquire innovative targets to discontinue the development of the targets' innovation projects in order to preempt future competition. We call such acquisitions \killer acquisitions." We develop a parsimonious model and provide empirical evidence for this phenomenon in drug development by tracking detailed project-level development histories of more than 60,000 drug projects. We show theoretically and empirically that acquired drug projects are less likely to be continued in the development process, and this result is particularly pronounced when the acquired project overlaps with the acquirer's development pipeline and when the acquirer has strong incentives to protect its market power. We also document that alternative interpretations such as optimal project selection, organizational frictions, and human capital and technology redeployment do not explain our results. Our conservative estimates indicate that about 7% of all acquisitions in our sample are killer acquisitions and that eliminating their adverse effect on drug project development would raise the pharmaceutical industry's aggregate drug project continuation rate by more than 5%. These findings have important implications for antitrust policy, startup exit, and the process of creative destruction.

Title:“Liquid Stock as an Acquisition Currency”

Authors: Johan Maharjan (Rensselaer Polytechnic Institute), Nishant Dass (Georgia Institute of Technology), Sheng Huang (China Europe International Business School) and Vikram Nanda (University of Texas at Dallas)

Abstract:

We examine how stock liquidity affects acquisitions. Relying on a simple model, we hypothesize that liquidity enhances acquirer stock as an acquisition currency, especially when the target is relatively less liquid. As hypothesized, we find that greater acquirer (lower target) liquidity increases acquisition likelihood and payment with stock, reduces acquisition premiums, and improves acquirer announcement returns in equity deals. To exploit the benefits of liquidity, firms take steps to improve stock liquidity prior to stock acquisitions. Our identification strategy relies primarily on the liquidity shock induced by stock-market decimalization. A supplementary test using the variation in stock liquidity induced by changes in composition of Russell-1000/2000 indices yields similar results.

Title: “Financial Protectionism, M&A Activity, and Shareholder Wealth”

Authors: Darius Miller (Southern Methodist University), David Godsell (University of Illinois) and Ugur Lel (University of Georgia)

Abstract:

This paper examines changes in M&A activity and stock market valuations around a significant law change that increased the protection of some U.S. industries against foreign acquirers. The Foreign Investment and National Security Act of 2007 (FINSA) dramatically increased scrutiny of M&A activity by the Committee on Foreign Investment in the United States (CFIUS). The additional scrutiny increased frictions for foreign investors seeking to acquire equity stakes in a large array of U.S. industries comprising approximately one-fourth of the Compustat universe. In a difference-in-differences research design, we find that foreign takeovers of FINSA-affected firms declined by 68% relative to our control group of unaffected firms. In contrast, domestic takeovers of FINSA-affected firms, which are not subject to CFIUS review, remain unchanged. We further find that FINSA-affected firms lost 0.43% of their value on average ($151.42 billion in total market value) over a three-day window surrounding five events related to the passage and implementation of FINSA. Across the event dates examined, we find negative [positive] cumulative abnormal returns (CARs) for FINSA-affected firms as the probability and severity of FINSA legislation increases [decreases]. The change in CARs is greater for firms with higher pre-FINSA predicted probability of future takeover and for firms with a higher likelihood of financial distress. Our findings suggest that financial protectionism, manifested in increased CFIUS scrutiny of M&A activity, harms shareholder wealth through a less liquid market for corporate control.

Title: “Congruence in Governance: Evidence from Creditor Monitoring of Corporate Acquisitions”

Authors: David Becher (Drexel University), Thomas P. Griffin (Drexel University) and Greg Nini (Drexel University)

Abstract:

We examine the impact of creditor control rights on corporate acquisitions, using covenant violations as an indicator of heightened creditor control. We show that private credit agreements frequently impose restrictions on borrower acquisition decisions. Following a covenant violation, creditors use their bargaining power to tighten these restrictions and limit acquisition activity, particularly deals expected to earn large negative announcement returns. Firms that do announce an acquisition while in violation of a covenant earn 1.8% higher stock returns, on average, with the effect concentrated among firms with weak external governance. We conclude that creditors and equity holders share congruent preferences to limit activity motivated by managerial agency conflicts.

Title: “Mergers & Acquisitions and Employee Job Search”

Authors: Ashwini Agrawal (London School of Economics and Political Science), Prasanna Tambe (University of Pennsylvania)

Abstract:

We use proprietary data from a job search website to reveal how employees look for new jobs around mergers and acquisition (M&A) announcements. This paper documents several new empirical findings. First, we observe a significant increase in employees’ job search activity approximately five months before an M&A announcement. In contrast, abnormal stock returns for target companies only materialize approximately one month before the announcement. Second, these employees target significantly lower wages in the outside labor market relative to other job seekers in the population. Third, employees who perform tasks that are sensitive to changes in organizational hierarchies show the greatest changes in search effort. We develop a model that incorporates M&A into a job search theoretic framework in order to interpret these findings.

Title: “Cross-Border Acquisitions and Employee Relations”

Authors: Hao Liang (Singapore Management University), Luc Renneboog (Tilburg University) and Cara Vansteenkiste (Tilburg University)

Abstract:

Using novel firm-level data on employee relations in an international sample of M&A deals, we find that shareholders react positively to an acquirer’s provision of employee-friendly policies around domestic acquisitions, but negatively in cross-border acquisitions. These effects are primarily driven by the provision of monetary incentives, and cannot be explained by country-level labor regulations or by target-level employee relations, and are concentrated on the acquirer’s returns rather than the target’s returns. Our findings suggest that acquirer shareholders view treating employees well favourably, as this can potentially reduce labor adjustment costs during a firm’s reorganization, but they dislike such generous employment benefits in cross-border acquisitions when uncertainties regarding post-merger integration are high.

Title: “The Value of Human Capital Synergies in M&A: Evidence from Global Asset Management”

Authors: David Schumacher (McGill University), Mancy Luo (Erasmus University) and Alberto Manconi (Bocconi University)

Abstract:

We use mergers in the global asset management industry to study the value human capital synergies. Following mergers, the average fund rebalances towards new investment areas, creating $18 million in additional value. We relate these synergies to improvements in internal labor markets: synergies are strongest for funds with managerial changes and in mergers that increase the size and complementarity of human capital expertise. This allows for a better matching of human to investment capital and points to a central benefit of mergers: the added flexibility to create value via discretionary increases in the size and quality of internal labor markets.

Outlook for M&A in 2018

22 February 2018

At the eighth Outlook for M&A event, Cass academics, industry practitioners from MARC's sponsor organisations (Acuris, Ardian, Credit Suisse and Willis Towers Watson) and other leading companies outlined their predictions for the Mergers and Acquisitions market in 2018.

The panel included:

· Chair: Susan Kilsby, Chairman, MARC Advisory Board and Chairman, Shire plc

· Giovanni Amodeo, Global Head of Research, The Mergermarket Group, Acuris

· Cyril Auger, Director, Ardian

· Cathal Deasy, Head of M&A for EMEA, Credit Suisse

· Jana Mercereau, Head of Human Capital M&A, Great Britain, Willis Towers Watson

· Professor Scott Moeller, Director of the M&A Research Centre, Cass Business School

· Philip Whitchelo, Vice President, Strategic Business Development, Intralinks

2017

Dean's Lecture in association with MARC - 11 October 2017

Baroness Delyth Morgan, CEO Breast Cancer Now

Baroness Morgan shared some of the lessons learnt from the merger of two charities that created Breast Cancer Now, making it the largest breast cancer research charity in the UK. "Mergers are not common in the charity sector," said Baroness Morgan. In 2015, when Breast Cancer Now formed, there were over 6000 mergers in the commercial sector compared to only 61 in the charity sector.

Click here to read the full story

Second Annual Cass Mergers and Acquisitions Research Centre Conference, 22 August 2017

The Mergers and Acquisitions Research Centre (MARC) at Cass Business School in cooperation with the European Corporate Governance Centre (ECGI) held the Second Cass Mergers and Acquisitions Research Centre Conference at Cass Business School, City, University of London on Tuesday, 22 August 2017.

Sessions took place between 8:30am and 5:30pm on Tuesday 22 August 2017. The keynote speech was delivered Michel Driessen, Partner, UK & Ireland Head of Operational Transaction Services, EY. The conference was attended by academics, PhD students and alumni.

Conference Programme

*(Author name in bold denotes presenting author)

Title: “Merger Activity, Stock Prices, and Measuring Gains from M&A”

Authors: Robert Dam (University of Colorado at Boulder) and Benjamin Bennett (Ohio State University)

Abstract:

With five percent of U.S. public firms acquired in a typical year, we show rational expectations perpetually embed a significant portion of acquisition gains into firms’ stock prices. We estimate 10% of a typical firm’s stock price can be attributed to general merger anticipation. As a result, the unobserved (anticipated) portion of the merger premium is roughly one-third of the observed premium, implying M&A event studies greatly understate the gain from mergers. Consistent with this hypothesis, announced deal premiums are strongly negatively correlated with the probability a firm will be acquired. Finally, we show a strong link from merger activity to stock prices, with each dollar of announced merger premiums associated with up to $44 of increased aggregate market valuation.

Title: “Tapping into Financial Synergies: Alleviating Financial Constraints Through Acquisitions”

Authors: Jie Yang (Board of Governors of the Federal Reserve System) and Rohan Williamson (Georgetown University)

Abstract:

The paper examines whether financially constrained firms are able to use acquisitions to ease their constraints. The results show that acquisitions do ease financing constraints for constrained acquirers. Relative to unconstrained acquires, financially constrained firms are more likely to use undervalued equity to fund acquisitions and to target unconstrained and more liquid firms. Using a propensity score matched sample in a difference-in-difference framework, the results show that constrained acquirers become less constrained post-acquisition and relative to matched non- acquiring firms. This improvement is more pronounced for diversifying acquisitions and constrained firms that acquire rather than issue equity and retain the proceeds. Following acquisition, constrained acquirers raise more debt and increase investments, consistent with experiencing reductions in financing constraints relative to matched non-acquirers. These improvements are not seen for unconstrained acquirers. Finally, the familiar diversification discount is non- existent for financially constrained acquirers.

Title: “A BIT Goes a Long Way: Bilateral Investment Treaties and Cross-border Mergers”

Authors: Brandon Julio (University of Oregon), Vineet Bhagwat (University of Oregon) and Jonathan Brogaard (University of Washington)

Abstract:

We examine whether Bilateral Investment Treaties (BITs) remove impediments to foreign investment by helping enforce contracts and protecting the property rights of foreign investors. We find that BITs have a large, positive effect on cross-border mergers. The probability and dollar volume of mergers between two given countries more than doubles after the signing of a BIT. Most of this increase is driven by capital flowing from developed economies to developing economies, shedding light on the long-standing Lucas Paradox as to why most cross-border capital still flows to developed countries. Additionally, most of our results are driven by target countries with “medium” levels of political risk, consistent with popular views that BITs are ineffective for countries with very high risk and not necessary for countries with low political risk.

Title: “International Trade and the Propagation of Merger Waves”

Authors: Eric de Bodt (Université Lille), Muhammad-Farooq Ahmad (IÉSEG School of Management) and Jarrad Harford

(University of Washington)

Abstract:

Cross-border merger activity is growing in importance. We map the global trade network each year from 1989 to 2014 and compare it to cross-border and domestic merger activity. Trade-weighted merger activity in trading partner countries has statistically and economically significant explanatory power for the likelihood a given country will be in a merger wave state, both at the cross-border and the domestic levels, even controlling for its own lagged merger activity. The strength of trade as a channel for transmitting merger waves varies over time and is affected by import tariffs cuts, Euro, EU, EEA, and WTO entry. Overall, the full trade network helps our understanding of merger waves and how merger waves propagate across borders.

Title: “Inefficiencies and Externalities from Opportunistic Acquirers”

Author: Wenyu Wang (Indiana University), Di Li (Georgia State University) and Lucian A. Taylor (University of Pennsylvania)

Abstract:

If opportunistic acquirers can buy targets using overvalued shares, then there is an inefficiency in the merger and acquisition (M&A) market: The most overvalued rather than the highest-synergy bidder may buy the target. We quantify this inefficiency using a structural estimation approach. We find that the M&A market allocates resources efficiently on average. Opportunistic bidders crowd out high-synergy bidders in only 7% of transactions, resulting in an average synergy loss equal to 9% of the target’s value in these inefficient deals. The implied average loss across all deals is 0.63%. Although the inefficiency is small on average, it is large for certain deals, and it is larger when misvaluation is more likely. Even when opportunistic bidders lose the contest, they drive up prices, imposing a large negative externality on the winning synergistic bidders.

Title: “Political Influence and Merger Antitrust Reviews”

Authors: Mihir N. Mehta (University of Michigan), Suraj Srinivasan (Harvard University) and Wanli Zhao (Southern Illinois University)

Abstract:

We document that firms in the constituencies of powerful U.S. politicians that oversee antitrust regulators receive favourable mergers and acquisitions antitrust review outcomes. To establish identification, we exploit a subset of politician turnover events that are plausibly exogenous as well as a falsification test using powerful politicians with no jurisdiction over antitrust regulators. Politician incentives to influence merger antitrust review outcomes appear to be driven by lobbying, contributions, and prior business connections. Our findings suggest that merger antitrust reviews are not independent of self-serving political intervention.

Title: "Product Market Dynamics and Mergers and Acquisitions: Insights from the USPTO Trademark Data"

Authors: Kai Li (University of British Colombia), Po-Hsuan Hsu (University of Hong Kong), Yunan Liu (University of Hong Kong) and Hong Wu (Hong Kong Polytechnic University)

Abstract:

Using a large and unique trademark-merger dataset over the period 1983 to 2016, we show that companies with large trademark portfolios, newer trademarks, and fast growth in trademarks are more likely to be acquirers, while companies with newer and more focused trademarks, and slower growth in trademarks are more likely to be target firms. Further, firms with overlapping product lines as captured by trademark similarity are more likely to be merged and these deals are associated with high combined announcement period returns. Post-merger, merger partners with overlapping product lines cancel more trademarks as well as to register fewer new trademarks, and are associated with lower costs of goods sold, lower advertising expenses, higher return on sales, and larger market shares. We conclude that eliminating product market competitors is an important driver of acquisitions.

M&A Society Conference 2017 - 14 March 2017

Managing Complex Deal Risks

On Tuesday 14 March 2017 the Cass PE and M&A Society hosted the 2017 Annual Cass PE M&A Conference at Cass Business School. The event focused on External Risks (regulatory changes, European elections, ‘Trump’, ‘Brexit’) and Internal Risks (due diligence, cyber security, post-merger integration).

Outlook for M&A in 2017 - 16 February 2017

Breakfast Panel Discussion

At the seventh Outlook for M&A event, Cass academics, industry practitioners from MARC's sponsor organisations (Ardian, Credit Suisse, EY, Mergermarket, and Willis Towers Watson), other leading companies and top financial journalists outlined their predictions for the Mergers and Acquisitions market in 2017.

The panellists were:

* Chair: Susan Kilsby, Chairman, Shire plc and Chairman, MARC Advisory Board

* Cyril Auger, Director, Ardian

* Michel Driessen, Transaction Advisory Services Markets Leader, UK & Ireland, EY

* Angus McIntosh, Managing Director EMEA, Mergermarket

* Professor Scott Moeller, Director of the M&A Research Centre, Cass Business School

* Laurence van Lancker, Managing Director, Head of Telecoms & Media M&A, Credit Suisse

* Silvi Wompa Sinclair, Head of Private Equity, Willis Towers Watson

Dean's Lecture in association with MARC - 15 February 2017

Dominique Senequier, President of Ardian: Sharing success in business

Talking about Ardian's success since its inception in 1996 (then part of AXA Group), Dominique Senequier attributed this to the company's employees, describing her team as “the strongest asset I have.”

Senequier believes in a vocal advocate of the power of ethical and responsible investment practices.

Since 2008, Ardian has pioneered the practice of sharing a portion of its capital gains on successful exits with employees of the companies involved.

Ardian also shares its own profits amongst its employees, with 80% of Ardian staff also being investors in the company.

This helps the organisation thrive because employees are willing to invest more in the company because their interests are fully aligned.

Watch Dominique's lecture here

Coverage of the event appeared in City AM and the Financial Times

2016

First Annual Cass Mergers and Acquisitions Research Centre Conference, 22 August 2016

The Mergers and Acquisitions Research Centre (MARC) at Cass Business School in cooperation with the European Corporate Governance Centre (ECGI) held the inaugural Cass Mergers and Acquisitions Research Centre Conference at Cass Business School, City, University of London on Monday, 22 August 2016.

Sessions took place between 8:30am and 5:30pm on Monday 22 August 2016. The keynote speech was delivered during lunch by Alan Giles, senior board member of the UK Competition and Markets Authority, also a board member of a FTSE 100 company. The conference was attended by academics, PhD students and alumni.

Conference organisers: Scott Moeller, Anh Tran, and Paolo Volpin

Conference Programme

*(Author name in bold denotes presenting author)

Title: 'Product Integration and Merger Success'

Authors: Gerard Hoberg and Gordon Phillips

Abstract:

We examine the importance of merger integration risk to the outcomes of mergers and acquisitions using new product-based ex ante measures of integration risk at the firm and firm-pair level. Our ex ante measures are significantly associated with ex post statements by managers in their 10-K indicating difficulties with merger and acquisition integration and also employee retention issues. We find that firms performing mergers and acquisitions in high product integration risk markets experience lower ex post profitability, higher ex post expenses, and a higher propensity to divest assets. Upon announcement, acquirers experience lower announcement returns and targets experience significantly higher announcement returns when product integration risk is high. Examining long-term stock market returns, we find that the well-known anomaly that acquiring firms have lower longer-term stock returns primarily occurs in markets where product integration risk is high.

Title: 'The Agency Costs of Public Ownership: Evidence from Acquisitions by Private Firms'

Authors: Andrey Golubov and Nan Xiong

Abstract:

We provide the first evidence on value creation in acquisitions by private operating _rms. Private bidders experience 16-20 per cent greater operating performance improvements following acquisitions than do public bidders. This difference is not due to differences in target types, merger accounting, financing constraints, private equity ownership or subsequent listing of some private bidders. Further analysis of governance arrangements allows us to attribute this effect to lower agency costs/better incentive alignment in private firms. Overall, not only do private firms pay lower prices for target firm assets, they also operate them more efficiently.

Title: 'Price and Probability: Decomposing the Takeover Effects of Anti-Takeover Provisions'

Authors: Vicente Cuñat, Mireia Giné and Maria Guadalupe

Abstract:

This paper studies the deterring effects of anti-takeover provisions on takeovers and identifies the channels through which they create or destroy value for firms, as well as for the economy as a whole. We provide causal estimates – that also deal with the endogenous selection of targets – showing that voting to remove an anti-takeover provision increases the probability of a takeover by 4.5% and leads to a 2.8% higher-than-expected premium, the latter resulting from increased competition for less protected targets. We also find evidence of net value creation in the economy as stemming from more related acquisitions and targets being matched to more valuable acquirers.

Title: 'The effect of takeover protection on the value of cash: Evidence from a natural experiment'

Authors: Eliezer M. Fich, Jarrad Harford and Adam S. Yore

Abstract:

Shareholders’ updated valuation of internal slack reveals their revised assessment of potential agency conflicts. We study how the value of internal cash changes following state antitakeover regulation events. After carefully addressing the critiques of such experiments, we find that the value of cash increases following antitakeover law implementation, but there is considerable heterogeneity in how the value changes. Firms more susceptible to quiet-life agency problems show no increases in the market-assessed value of internal slack. Conversely, cash appreciates in companies where takeover protection helps bond important commitments with major counterparties. These findings hold across different measures of antitakeover protection events.

Title: 'Shareholder Approval in Mergers & Acquisitions'

Authors: Kai Li, Tingting Liu and Julie Wu

Abstract:

This paper provides one of the first large sample studies documenting a positive causal effect of shareholder approval in corporate decision making. Using a hand-collected sample of U.S. mergers and acquisitions (M&As) that involve all-stock payment over the period 1995-2015, we examine whether and how the requirement of shareholder approval affects deal quality. Our identification strategy relies on listing rules of the NYSE, AMEX, and NASDAQ that shareholder approval is required when an acquirer intends to issue more than 20% new shares to finance a deal. We examine acquirer price reaction to deals in which acquirers intend to issue either above or below the 20% threshold by a small margin. The regression discontinuity design works well in all-stock deals due to acquirer management’s inability to precisely manipulate share issuance and thus provides a clean causal estimate of the effect of shareholder approval on M&As. We find a large and significant 4.3% jump in acquirer announcement returns at the 20% threshold. We further show that this positive value effect is concentrated among acquirers with more effective shareholder monitoring and among acquirers buying target firms with more severe information problems. We provide some suggestive evidence on the underlying economic mechanisms behind this positive value effect: The requirement of shareholder approval commits acquirer management to seek deals with larger synergies and strengthens its bargaining position vis-à-vis target management. Finally, we show that shareholder approval leads to better post-merger operating performance in acquirers with high institutional ownership. We conclude that the requirement of shareholder approval is effective in addressing agency problems.

Title: 'Does Mandatory Shareholder Voting Prevent Bad Acquisitions?'

Authors: Marco Becht, Andrea Polo, and Stefano Rossi

Abstract:

Shareholder voting on corporate acquisitions is controversial. In most countries acquisition decisions are delegated to boards and shareholder approval is discretionary, which makes existing empirical studies inconclusive. We study the U.K. setting where shareholder approval is imposed exogenously via a threshold test that provides strong identification. U.K. shareholders gain 8 cents per dollar at announcement with mandatory voting, or $13.6 billion over 1992-2010 in aggregate; without voting U.K. shareholders lost $3 billion. Multidimensional regression discontinuity analysis supports a causal interpretation. The evidence suggests that mandatory voting imposes a binding constraint on acquirer CEOs.

Title: 'Weak Governance by Informed Large Shareholders'

Authors: Eitan Goldman and Wenyu Wang

Abstract:

A commonly held belief is that better informed large shareholders with greater influence improve corporate governance. We argue that this may not be true in general and demonstrate our argument in a model of corporate takeovers. We show that a large shareholder’s ability to collect information and trade ex post may cause him to prefer, ex ante, managers who pursue risky takeovers, even if such takeovers generate a negative expected return. We test the model’s main predictions regarding institutional investors’ trading around corporate takeovers. Consistent with the model, we find that institutional investors increase their holdings in firms that subsequently pursue acquisitions with greater performance variability and that following takeover initiation, institutional trading positively correlates with long-run deal performance. We further document that these trading patterns are more pronounced when the institutional investor has larger initial holdings of acquirer shares, when the acquirer accounts for a larger fraction of the institution’s portfolio, and when the institutional investor demonstrates better trading ability prior to acquisitions. Overall, our study sheds light on the limits of relying on better informed large shareholders to improve corporate governance.

Title: 'Board Changes and the Director Labor Market: The Case of Mergers'

Authors: David Becher, Ralph Walkling & Jared Wilson

Abstract:

We examine the stability and composition of acquirer boards around mergers and the director characteristics associated with selection for the post-merger board. Our results indicate that the post-merger board changes substantially and variation is significantly different from both non-merger years and non-merging firms. Adjustments reflect firms upgrading skills associated with executive and merger experience and bargaining between targets and acquirers, rather than agency motives. Conversely, director selection at non-merging firms is driven by general skills and diversity. Our analyses provide insight into the dynamic nature of board structure and characteristics valued in the director labor market.

M&A Journalism Panel Event - 11 May 2016

The Mergers and Acquisitions Research Centre at Cass (MARC) and The Department of Journalism at City University London hosted a panel discussion and audience debate looking at the past, present and future of M&A reporting.

More than 100 professionals, journalists and students attended the breakfast briefing which was co-chaired by the Director of MARC, Professor Scott Moeller and Professor Steve Schifferes, Professor of Financial Journalism at City.

Panellists were:

- Lianna Brinded, Business Insider

- Lucinda Guthrie, Mergermarket

- Arash Massoudi, Financial Times

- Anita Raghavan, New York Times / Dealbook